1. Executive Summary

Al Najof Fiberglass (ANF) is a manufacturer of fiberglass products in Dammam, Saudi Arabia, with a website at alnajoffiberglass.com (home page present).

From an SEO perspective:

- The site has good potential: a clear niche (fiberglass manufacturing), a defined location (Dammam / Saudi Arabia) and presumably local demand.

- However, at a high level, there appear to be shortcomings: limited public visibility of on-page optimisation (meta tags, structured data), unclear backlink profile (publicly visible), and possibly limited content geared to search keywords and user journeys.

- The opportunity: by improving on-page SEO, local / regional targeting, content strategy, technical performance and link building, ANF can increase organic search traffic, generate more leads, and reinforce its local competitive advantage in Dammam/Eastern Province.

In short: this is a good foundation but to unlock full organic search potential, an SEO “lift” is required.

2. Business & Website Context

2.1 Business Overview

- ANF is located at 11th Street, Al-Adamah, Dammam 32242, Saudi Arabia.

- It presents itself as “the top manufacturer of high-quality fiberglass products in Dammam, delivering durable, custom solutions for industrial, commercial, …” on its website.

- The business is likely competing with other fiberglass / composites manufacturers both locally (Eastern Province) and regionally (Saudi Arabia, Gulf).

2.2 Website Overview

- Root domain: alnajoffiberglass.com

- Key pages observed: Home, About, Products, Contact.

- The site appears to serve as a corporate/manufacturer website (branding + product info) rather than heavy e-commerce.

2.3 Target Audience & Keywords (Inferred)

- Local/regional businesses in Saudi Arabia (and possibly GCC) needing fiberglass / composite products (tanks, pipes, panels, custom solutions).

- Likely keywords (to verify via research): “fiberglass manufacturing Dammam”, “fiberglass tanks Saudi Arabia”, “fiberglass products Dammam”, “fiberglass custom solutions Eastern Province”, etc.

- Local search intent is relevant: businesses searching for “fiberglass manufacturer near me” (in Dammam/Eastern Province) should find ANF.

3. SEO Audit Findings

Below is a breakdown across On-Page, Technical, Off-Page, Local SEO.

3.1 On-Page / Content

Strengths:

- The website clearly states its manufacturing focus and, at least from visible pages, uses location (Dammam) which is useful for local SEO.

- Presence of dedicated “Products” page indicates intent to show offerings.

Weaknesses / Areas to Improve:

- Titles & meta descriptions: From cursory view, titles may be generic (e.g., “Home – Al-Najof Fiber Glass”) which do not fully leverage keyword opportunities (e.g., “Fiberglass Manufacturer Dammam | Al-Najof Fiber Glass”).

- Heading tag structure: Without full crawl data I cannot verify, but likely improvements possible in H1/H2 usage (include target keywords + local modifiers).

- Content depth: The website appears to offer brief product listing rather than long-form, keyword-rich content (e.g., case studies, technical guides, blog). This limits ranking potential for broader informational queries (“how to choose fiberglass tanks”, etc.).

- Keywords and internal linking: Internal linking between pages (e.g., product → case studies → blog) appears limited; this reduces topical authority.

- Images and alt-attributes: No guarantee all images have descriptive alt text or are SEO-optimised (filename, compression, load time) — needs audit.

3.2 Technical SEO

Strengths:

- The website is live, reachable, and has standard pages (home/about/contact) — good baseline.

Weaknesses / Areas to Improve:

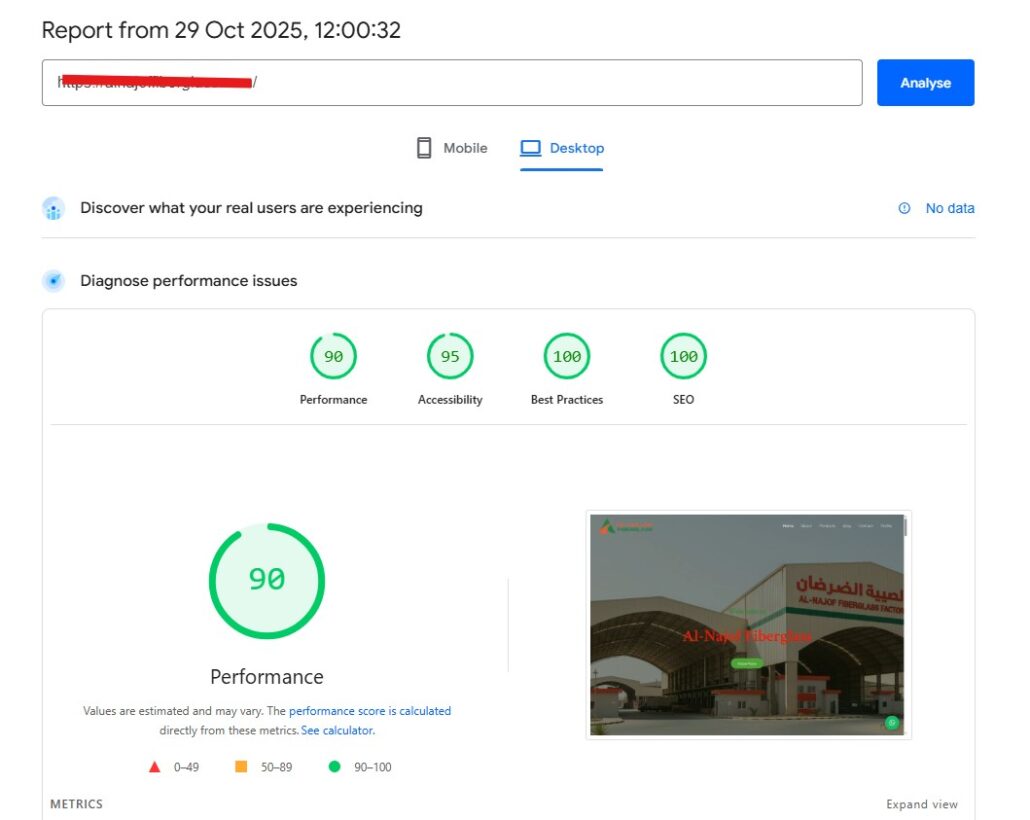

- Page speed / mobile performance: Given many manufacturer sites are image heavy and may use non-optimised assets, a speed audit (via Google PageSpeed) is advised. Slow loading on mobile negatively impacts SEO and user experience.

- HTTPS: The site URL uses HTTPS — good. (e.g., “https://alnajoffiberglass.com” appears)

- XML sitemap & robots.txt: Need to verify existence and correctness (common omission).

- Structured data / schema: No visible structured data markup (e.g., LocalBusiness, Product, Organization) in public HTML (to be audited). Use of schema.org helps SERP visibility (rich snippets).

- Mobile-friendly: Given most searches in Saudi are via mobile, ensure responsive design and mobile usability via Google’s Mobile-Friendly test.

- Broken links / crawl errors: A full technical crawl (via Screaming Frog, etc.) recommended to identify 404s, redirect chains, duplicate content, canonical issues.

- International targeting: Since business is in Saudi Arabia and likely Arabic + English audience, ensure proper hreflang tags or dedicated language versions (if bilingual). If only English, consider Arabic version for local market.

3.3 Off-Page / Backlinks & Authority

Strengths:

- As a local manufacturing business with presumably longstanding operations, there may be offline reputation and local business directories which can be leveraged.

Weaknesses / Areas to Improve:

- Publicly visible backlink data is limited; likely low domain authority relative to larger competitors. Building quality backlinks (industry directories, local associations in Eastern Province, supplier/partner mentions) is key.

- Social signals: The Facebook page exists (Al-Najof Fiberglass – Dammam) but engagement level may be low.

- Reviews & testimonials: Online reviews (Google My Business, industry portals) help build trust, but I could not locate many visible user-reviews linked to the website.

3.4 Local SEO

Strengths:

- Business located in Dammam, address is clearly listed on website: “11th Street, Al-Adamah-4252, Dammam-32242”.

- Local manufacturing niche appeals to local/regional searchers.

Weaknesses / Areas to Improve:

- Google My Business (now “Google Business Profile”): I did not prominently find a fully optimized listing with consistent NAP (Name/Address/Phone) plus reviews, photos, posts. This is essential for local visibility (especially for “fiberglass manufacturer Dammam”).

- Local keywords: Need content pages optimized for “Dammam”, “Eastern Province”, “Saudi Arabia” modifiers.

- Local directory citations: Presence in Saudi / GCC industrial/manufacturer directories should be verified, consistent NAP and industry categorization.

- Reviews: Encouraging clients to leave reviews on Google and other platforms will aid local SEO.

4. Key Opportunities

From the audit findings, the following opportunities stand out:

- Keyword-rich content strategy – Create focused landing pages and blog posts around key search intents: e.g., “Custom fiberglass tanks Saudi Arabia”, “Fiberglass panels vs steel Eastern Province”, “How to select a fiberglass manufacturer in Dammam”. These will capture both informational and transactional searchers.

- On-page optimisation – Revise title tags, meta descriptions, heading structures, image alt text, internal linking to reflect the target keywords and local modifiers (Dammam, Eastern Province, Saudi Arabia).

- Technical performance uplift – Improve site speed (especially mobile), implement structured data markup (LocalBusiness, Product, Organization), ensure crawlability/sitemap/robots.txt, fix any broken links or duplicate content.

- Local SEO dominance – Fully optimise Google Business Profile (GBP), encourage reviews, include accurate NAP across directories, create content referencing local region, build citations and inbound links from local industry associations, chamber of commerce.

- Backlink building & domain authority – Secure high-quality backlinks: from industrial directories, partner/supplier websites, local Saudi manufacturing associations, regional industry publications. Develop thought-leadership content (white-paper, case-study) that can attract links.

- Multilingual targeting (if applicable) – If not yet done, consider an Arabic version of the website, to better capture Arabic-language searchers in Saudi Arabia. Use hreflang tags appropriately.

- Lead conversion optimisation – Ensure calls-to-action (CTAs) are present (e.g., “Request a quote”, “Contact us for custom solutions”), and that forms/buttons are easily accessible (on desktop + mobile). While not strictly SEO, better conversion supports overall ROI from increased traffic.

5. Proposed Roadmap & Timeline

Here is a high-level implementation roadmap over next 6-12 months:

| Phase | Duration | Key Activities |

|---|---|---|

| Phase 1 – Quick Wins (Month 0-1) | 1 months | • Audit site speed / mobile usability & fix major issues. • Revise title/meta for main pages (Home, About, Products). • Ensure HTTPS, sitemap, robots.txt are correct. • Claim/optimize Google Business Profile; add photos, NAP, business hours, description. |

| Phase 2 – Foundation (Month 1-2) | 1 months | • Keyword research (local + industry) and mapping to pages. • On-page restructuring: headings, internal links, alt text, image compression. • Create new landing pages / blog posts for priority keywords. |

| Phase 3 – Local & Authority Building (Month 2-4) | 2 months | • Build local citations (directories, chambers, industry associations). • Encourage client reviews on GBP and other platforms. • Begin link-building outreach: guest posts, partner mentions, regional industry blogs. • Create case studies / success stories (with visuals) to publish and promote. |

| Phase 4 – Expansion & Scale (Month 4-6) | 2 months | • Consider Arabic version of site (if not yet) and hreflang if needed. • Expand content library: long-form guides, technical specs, FAQs. • Monitor performance: traffic, keyword rankings, conversion. Adjust strategy accordingly. • Explore paid promotion (optional) and integrate with SEO for holistic inbound. |

6. Metrics & KPIs to Track

To measure success of the SEO effort, the following metrics should be monitored (using tools like Google Analytics, Google Search Console, Google Business Profile, Ahrefs/Moz etc.):

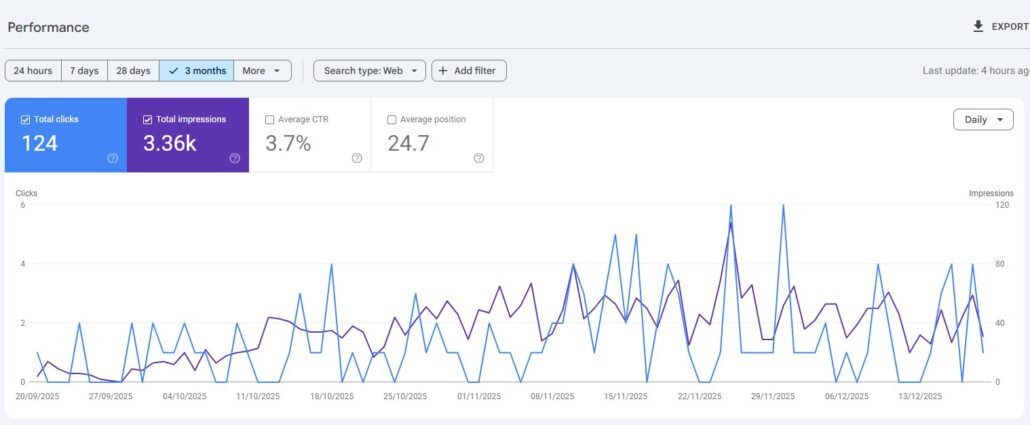

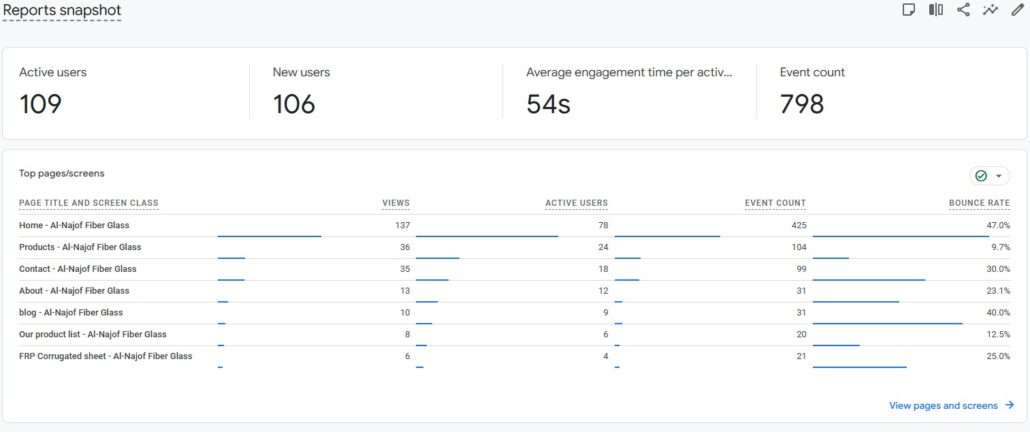

- Organic traffic (sessions) from search engines, especially from Saudi Arabia/Eastern Province.

- Keyword ranking improvements for target keywords (e.g., “fiberglass manufacturer Dammam”, “fiberglass tanks Saudi Arabia”).

- Number of keywords in top 10/20 positions.

- Google Business Profile metrics: views, search queries, calls, direction requests.

- Conversion rate: number of lead form submissions / quote requests via website.

- Backlink metrics: number of referring domains, domain authority improvements.

- Page load times (mobile + desktop) and bounce rate improvements.

- Local citation consistency (NAP across directories) and review count/average rating score.

7. Risks & Considerations

- Manufacturing niche – search volume for very specific terms may be moderate; success will rely on capturing highly relevant, high-intent queries rather than broad consumer keywords.

- Competition – other regional manufacturers may already have strong SEO presence; differentiating via content, locality, service will be key.

- Content resource – to build in-depth articles and case studies, investment in content creation (writing, photography, video) may be required.

- Review dependency – local SEO benefits from positive reviews; if reviews are low, progress may be slower.

- Technical debt – if the website has underlying legacy CMS or heavy unoptimised assets, technical improvements may take time.

8. Conclusion

For Al Najof Fiberglass, the website provides a good baseline, but there is considerable opportunity to improve organic visibility, local search dominance, and lead generation via SEO. By implementing the above recommendations (on-page, technical, local, authority building) and tracking meaningful KPIs, the business stands to increase qualified inbound enquiries, reinforce its brand locally in Dammam/Eastern Province, and gain a competitive edge among fiberglass manufacturers in Saudi Arabia.

If you like, I can prepare a detailed technical audit report (with crawl data, speed metrics, backlink profile), or a content roadmap (with keyword list and content titles) for you. Would you like me to proceed with one of those?